What Is an MCA?

Mes Merchant cash advances (MCAs) are loans provided by lenders rather than traditional banks, which differ in several ways from regular bank loans. Lenders who offer merchant cash advances will examine your credit card receipts to assess how much cash is necessary and if repayment can be managed. A contract signed with MCA lenders will outline how much money was borrowed and any associated interest costs; rates can differ between companies and states and may even impose limits on interest charges that need to be repaid back; interest charges vary accordingly.

What Does an MCA Lender Purchase?

In essence, an MCA lender purchases future sales transactions. With their contract in hand and assessments of sales made to assess whether they will loan money quickly to you – one key benefit being instant access to cash!

If your coffee shop has experienced water damage that requires immediate repair but doesn’t have enough funds, a Merchant Cash Advance (MCA) could be an efficient and quick way to raise funding for those repairs.

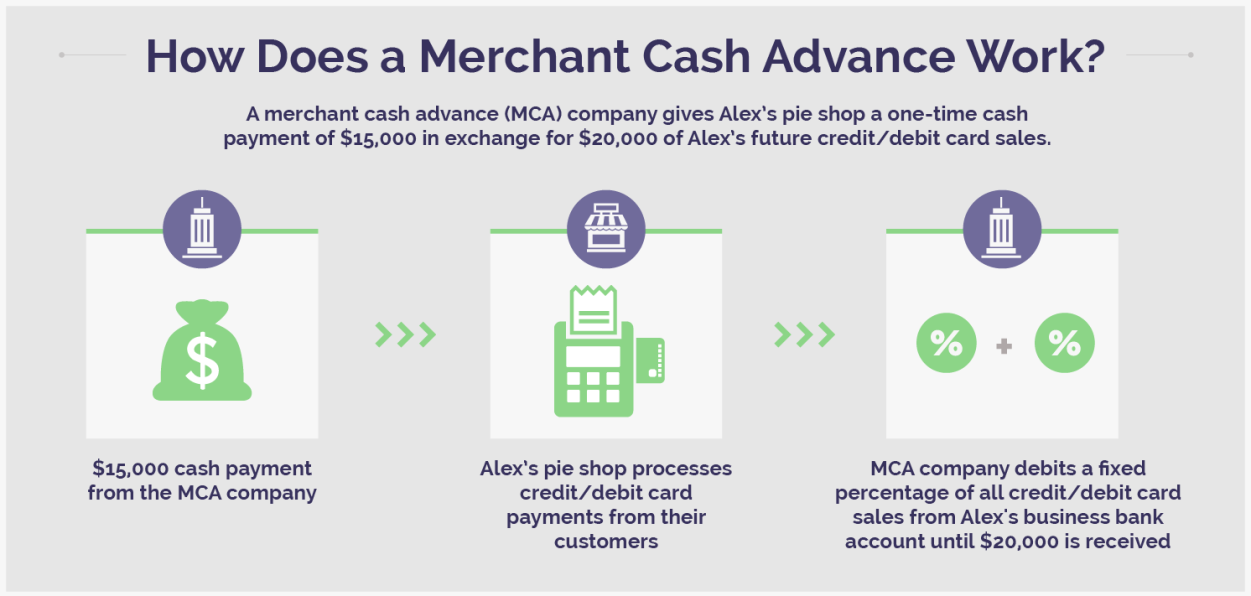

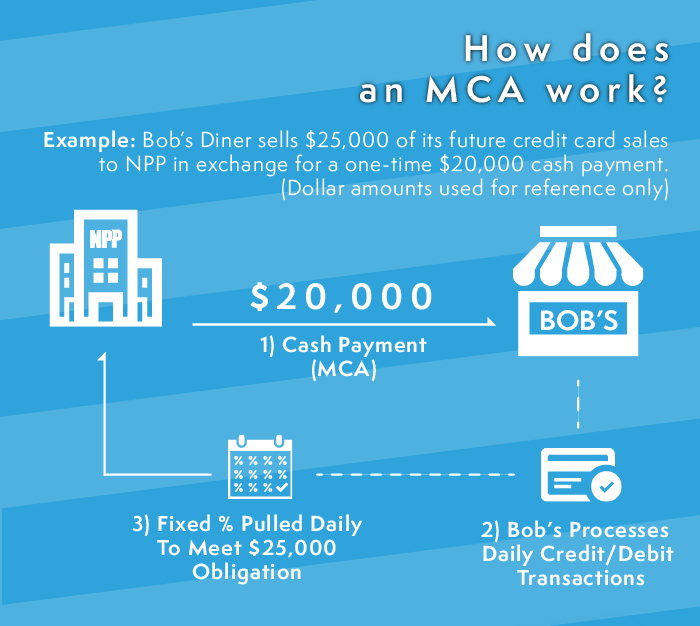

How Does an MCA Work?

While getting an MCA may not require as rigorous a process as loan approval, you still must abide by a contract when seeking one to assist your business.

Advance Amount Your MCA contract sets aside an agreed-upon advance amount from your lender for use as a merchant cash advance (MCA). You must assess and ask for precisely what is necessary, or else more must be repaid later. Your advance could be less than, equal to, or greater than monthly sales – depending on what amount is necessary and your comfort with repaying this money every day back into the lender.

Payback Amount

Your payback amount will likely exceed the advance amount since MCA lenders charge a factor, or fee, in addition to lending money upfront. Sometimes, this factor amount can even exceed other loans’ interest rates!

Holdback

To repay a merchant cash advance, a daily levy will be deducted from credit card transactions. Before applying for one, you should review your sales to assess its viability during the payback period.

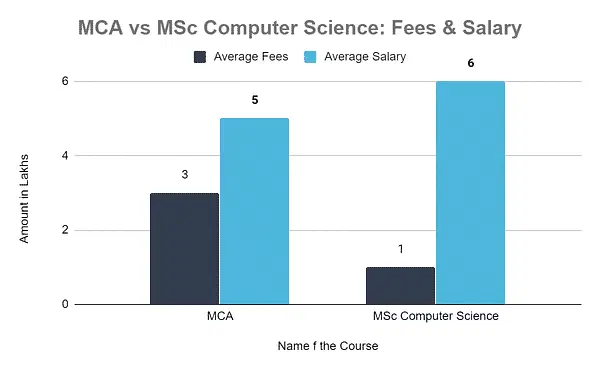

MCA Fees and Cost

Your total MCA fees and costs depend on various factors, such as which company provides it and the terms you agree upon; highly qualified businesses often enjoy more favorable conditions.

Pros and Cons of an MCA

Fast cash can be an essential element of business growth for small companies. Before signing on with any lender to secure a merchant cash advance loan, understanding all its pros and cons will give you a better idea of what lies ahead.

Pros

A merchant cash advance (MCA) can quickly give your business access to money they need for projects or improvements you wish to complete or make, thus giving it more financial flexibility than traditional sources such as loans.

Unlike loans, an MCA doesn’t require collateral as security; you won’t have to stress over your credit score too much when applying. While MCA lenders will pull your score anyway, MCAs tend to be more understanding for businesses with poor or moderate credit histories.

An alternative lender could offer more flexible payment terms; should sales slow, this could allow them to alter your daily holdback of transactions as necessary.

Cons:

Because merchant cash advances come with additional costs, their high payback amount could do more harm than good if your sales drop unexpectedly; paying back your advance could sap needed profits and diminish revenues.

Due to MCAs not being regulated, their payback accounts often feature higher-than-usual interest charges than traditional bank loans – this may present difficulties later if your debt becomes more excellent than you can manage. However, payback periods tend to be shorter than with loans.

Are Merchant Cash Advances the Answer to Their Woes

A merchant cash advance (MCA) may be ideal for small businesses needing additional funding to become more cost-efficient and functional. Still, it cannot secure bank loans to cover all their desired expenditure.

An MCA may not be appropriate for businesses experiencing a major disaster that has rendered daily transactions impossible. Instead, traditional bank loans or grants offer better solutions as they do not expect daily transactions as part of repayment obligations.

An MCA may be appropriate for small businesses just starting that wish to make non-interruptive upgrades without incurring financial strain; however, if you prefer another form of financing, we suggest reviewing our guide to the top merchant account services available today.

Alternatives to Merchant Capital Accounts

Even if your business doesn’t qualify for an MCA for any reason, alternatives may still be available. One popular choice among such companies is a high-risk merchant account, which fills an essential need in many industries that would otherwise be barred from traditional financing solutions like MCAs. For more information about available high-risk merchant account providers today, visit our guide to the best merchant account services.

Understanding the Risks Involved

Merchant cash advances offer fast access to cash, but it’s crucial for business owners to fully comprehend all the associated risks before entering into such financial arrangements. One significant risk is factor rate increase which could significantly raise payback amounts in slower sales periods – potentially burdensome if your margins are already tight. It is essential to assess cash flow carefully to determine if higher repayment amounts won’t compromise financial stability and be handled comfortably without incurring unnecessary debt or becoming burdensome for you and your company.

Impact on Cash Flow

Since merchant cash advances require daily holdbacks from credit card transactions, assessing their impact on your company’s cash flow is critical. Withholdings could reduce available funds for everyday expenses, so planning and budgeting accordingly during the payback period is crucial. Business owners should examine historical sales data to ensure the holdback amount can be accommodated without disrupting regular operations.

State Regulations and Compliance

One factor often overlooked in merchant cash advances is varying state regulations. Depending on where your business is based, interest rate caps could restrict lenders who provide MCA loans – it’s, therefore, essential that you are fully informed about how this may impact the cost of MCAs and consult legal advice or an expert financial advisor to navigate any complications that may arise in doing business in that state.

Merchant cash advances may accommodate businesses with poor or mediocre credit more. Yet, it’s still essential to remember that lenders will conduct a credit check during their application process. While your credit score won’t necessarily determine eligibility or terms and conditions of an MCA loan agreement, higher scores could mean more favorable rates and repayment terms.

Exploring Other Funding Solutions

While an MCA may be appropriate for some small businesses, other funding sources should always be explored, as alternatives are always worth pursuing. These may include traditional bank loans, Small Business Administration (SBA) loans, or even seeking investment from private investors. Each option has advantages and disadvantages that must be evaluated against your business’s unique requirements and financial situation before making your final decision.

Before entering into any agreement with an MCA lender, it is imperative to read through and assess their terms and conditions carefully. Pay special attention to interest rates, factor rates, holdback amounts, and repayment terms – legal counsel may offer invaluable assistance here as it offers additional protection and clarity before committing to financial arrangements.

Building a Strong Financial Foundation

Merchant Cash Advance (MCA) loans may provide short-term assistance for small businesses but should not be seen as long-term solutions. To ensure lasting growth and success, companies should focus on creating a firm financial foundation by effectively budgeting, maintaining healthy cash flow, and exploring avenues for increasing revenue streams. By strengthening the core of their financial operations, future funding needs will be better handled.

Timing Is Key

Timing is of the utmost importance when considering an MCA. Businesses should carefully assess whether they need funds immediately or can wait for alternative financing options; making an MCA decision without thoroughly examining its impact could create more severe difficulties later.

Professional Financial Advice

While this article gives an overview of MCAs, every business’s financial situation varies greatly, and therefore seeking professional advice from accountants, financial advisors, or business consultants before selecting any funding option can provide personalized insights and guidance tailored specifically to their unique business requirements.

Comparing MCA Providers

Not all MCA providers are created equal, and their terms and conditions can differ considerably from lender to lender. Before finalizing an agreement with one lender or another, it’s wise to compare offerings from multiple lenders – this will enable business owners to secure the best possible loan deal tailored to their unique requirements.

Calculating the True Cost of an MCA

Businesses should calculate their principal amount and factor rate expenses to make an informed decision about their MCA costs. By understanding their overall expenses, business owners can assess whether immediate cash flow outweighs higher borrowing costs associated with MCAs.

Assess Long-Term Impact

Although an MCA provides quick access to funds, its long-term effects on the business must be considered carefully before deciding on one. Will an MCA help your company reach key goals and increase profitability, or will it burden it with large repayments? Evaluating its advantages and drawbacks is necessary for making an informed decision.

Businesses looking to obtain additional funding should carefully consider how committing to an MCA might impact their creditworthiness in the future. An MCA could impede other loans or financing solutions from being secured for your business in the future, so careful thought must be given when considering such a commitment.

Exploring Grants and Subsidies

Depending on the nature and activities of a business, grants or subsidies from government agencies or private organizations may provide non-repayable funds that support growth without incurring debt. Investigating these options could provide businesses with funds that support development without incurring obligations.

Due Diligence on MCA Lenders mes With the growing popularity of mortgage-collateralized arrearage (MCAs), lenders have emerged. You must conduct due diligence on potential MCA lenders to verify their legitimacy and reputation before entering any financial agreement. Research customer reviews, check for complaints against them, and verify credentials before agreeing.

Building Emergency Savings

Unexpected emergencies can be particularly challenging for small businesses, so having an emergency savings fund may provide greater peace of mind while decreasing short-term borrowing costs.

Prepare for Loan Repayment

Though MCA loans provide more flexible payment options than traditional loans, businesses should still prepare for their repayment process by forecasting cash flow and ensuring sufficient funds are available each day to meet daily holdback requirements. Careful planning will prevent cash flow disruptions during repayment.

Before making significant financial decisions, seeking customer feedback can be immensely valuable. By understanding customer preferences and expectations, companies can better tailor the investments made with funds gained through MCAs to suit customer requirements – increasing their chances of success and profits.

Consider Exploring Industry-Specific Financing Options

Each industry presents its own financing needs and challenges so businesses may find more suited financing solutions in industry-specific packages than an MCA agreement. For instance, firms involved with technology might consider venture capital funding, while healthcare businesses could explore medical equipment financing.