In response to high inflation, the Federal Reserve raised rates again this year.

The Federal Reserve recently announced its seventh increase to the federal funds rate and signalled its intentions to increase interest rates further. To control rampant inflation, which has reached 40-year highs, they have raised rates on multiple occasions this year; but recent signs point towards potential cooling of inflationary pressures.

Higher interest rates may help control rising prices but at the cost of increased borrowing costs that make everyday financial products such as mortgages, personal loans and credit cards more expensive.

Given the current economic environment and rising interest rate environment, saving money and paying down high-interest debt has become more palatable. Select explores what you should do with your money after the Federal Reserve increased interest rates.

Why the Fed’s decision to raise rates should prompt us to start saving and paying down debt

An intricate web of factors influences the economy and interest rates in general, making it nearly impossible to forecast future rates with any accuracy accurately. There are no indications that rates are poised to drop anytime soon – indeed, the Federal Reserve plans to continue its rate hikes until 2023! Even if economic forecasts suddenly shift unexpectedly, focusing on core fundamentals that keep you on a solid financial footing remains essential.

Thus, now is an opportune moment to evaluate your saving approach and assess any debt with variable interest rates that affect your budget.

Savings accounts are now paying more At the height of the pandemic; savings accounts yielded negligible interest; even high-yield savings accounts typically had annual percentage yields (APYs) under 1%. Now, however, savings accounts are offering much better interest rates.

At a time of high-interest rates, savings accounts can provide even greater returns than previously. Some high-yield savings accounts offer rates exceeding 4% with no monthly fees required to access them.

At this time, a UFB Premier Savings account offers up to 4.81% APY with no minimum balance requirement and no monthly fees. High-yield savings accounts from Marcus by Goldman Sachs and LendingClub also boast attractive APYs of at least 3%.

Borrowing Costs Will Rise, But Remain at Record Lows

Business loan interest rates briefly dropped below 4% last year; that didn’t last, though; an average small business loan is now approaching as high as 8%; nevertheless, it is essential to remember that borrowing costs still represent significant discounts from past experiences; another 75 basis points from the Federal Reserve is no small sum, and will ripple throughout bank lending markets and influence pricing decisions accordingly.

“Every time the Federal Reserve raises rates, there is an impactful ripple-through to all interest rate indices,” stated Chris Hurn, founder and CEO of Fountainhead Lending Services, specializing in small business lending.

Hurn explained that with historically low-interest rates, monthly interest payments for business owners shouldn’t be significantly affected by headlines suggesting otherwise. He pointed out that even taking on debt for equipment costing $200,000 will incur only slightly increased payments (more or less depending on the amortization period) without significant negative implications on cash flow.

Hurn stated, “People can tolerate up to several hundred basis points.”

Rohit Arora, co-founder and CEO of Biz2Credit (which specializes in small business lending), noted that most business owners could accommodate an interest rate increase of 75 basis points over 10 years loan term. “It’s not significant when taken as part of their overall costs,” Arora continued.

Bank lending requirements are tightening, and that process will accelerate. Rising rates could hurt small businesses in several ways: economically and market-related effects may loom large among them.

The Federal Reserve needs to calm the economy to lower inflation, which should assist small businesses with managing costs for labour and inventory.

“Business owners understand it’s in the greater good,” Hurn noted. They can no longer raise wages and inventory costs to pass along to customers without action being taken by the Fed to curb inflation. Even if it costs more initially, I believe it will only last temporarily, so they should bear it as part of taming down inflation,” he said.

Wall Street expects the Federal Reserve to begin cutting rates as early as March 2023 due to an anticipated weakening economy, and this economic outlook will drive borrowing trends and borrowing trends accordingly.

Hurn explained that banks become concerned, and the number of eligible loan applicants decreases, prompting banks to limit loan eligibility further.

Since he started lending over 20 years ago, he has seen this scenario play out multiple times as banks and credit unions tighten up when lending business loans as economic uncertainty mounts. Banks effectively “go off the grid”, according to him.

Recent data demonstrates that business loan approval rates remain steady monthly; however, credit policies at banks ranging from local community banks to regional and national institutions have tightened as the economy heads for recession.

Hurn noted, “This process is already occurring and will accelerate further.”

Banks and financial institutions have fared much better since 2008.

More will weather the storm by scaling back on financing expansion plans,” according to him.

Owners should expect their debt service coverage ratios, the operating income available to service debt principal and interest, to increase from a minimum level of 1.25 to 1.5.

Hurn predicted that many businesses “won’t be able to meet those numbers”, as is usually the case during such cycles.

Arora noted that more restrictive loan covenants, known as covenants, have begun being implemented into contracts as the economy adjusts back. Business owners are expected to experience more of these types of restrictions from banks as 2020 progresses.

SBA 7(a) loans will get more attention, variable rates are a factor

SBA 7(a) loans will receive more consideration, with variable rates becoming an essential component. Because banks are becoming stricter in lending doesn’t mean growth capital requirements have decreased.

Small business lending demand has decreased because many business owners have already received assistance through programs such as Paycheck Protection Program and the SBA Economic Injury Disaster Loan program. But as rates began rising, demand spiked again just when rates started going up, similar to how consumers now run through their pandemic stimulus savings while simultaneously encountering tighter lending conditions.

SBA 7(a) loans may be slightly more costly than bank loans, but their availability will offset this expense. Current bank loan interest rates range between 6%-8%, while SBA loans have an interest rate of 7%-9%.

As banks halt lending activity, SBA lenders such as Fountainhead and Biz2Credit report increased activity from their SBA loan program. According to these two lenders, this trend has already begun taking shape.

“We are already witnessing a shift in volume,” Arora stated. “Over the past three or four weeks, our volume has steadily increased.”

Most loans obtained through the Small Business Administration 7(a) loan program are variable interest loans, meaning their interest rate resets every 90 days by changes to the prime rate, plus up to an additional SBA rate of up to 2.75%. Federal Reserve rate hikes increase the prime rate and consequently will cause monthly debt payments through this program to become higher; any new loans would also reflect this exceptional rate adjustment.

Nearly 90% of SBA 7(a) loans are variable-rate loans that follow the prime rate plus the SBA spread and often adjust quarterly as the prime rate fluctuates.

Bank loans already contain many of the expected interest rate hikes; however, due to SBA loan lag, individual business owners who come under 90-day rolling windows for interest rate reset should expect a higher monthly payment when taking out an SBA loan – though considering their lengthy amortization schedules – between 10 years for working capital/equipment loans and up to 25 years for real estate – this difference won’t be significant.

Last fall, small business administration loans (SBA loans) typically ranged between 5% to 6% for business owners; now, these loans can run as high as 7.5% – low 8%, often coming with rates 50 basis points to 75 basis points higher than bank loans.

Hurn said the main benefits are extended amortization periods and reduced covenant requirements.

Increased interest in SBA loans should persist for some time, according to Arora; however, with another 250 basis points of rate hikes from the Fed this year and further tightening by earlier decisions (150 basis points in September and 25 in subsequent meetings) expected, demand could start waning again. Wall Street projections anticipate two more hikes from the Fed this year after Wednesday, with 75 basis point increases at September 50 meeting and 25 meetings following in 2022, totalling 150 basis points uptick from Wednesday’s meeting — counting 300 basis points total with tightening and tightening done earlier this year! Wall Street forecasts anticipate two more rate hikes this year with another 75 basis point increase after Wednesday – Wall Street forecasts predict two further hikes from Wednesday’s meeting! Wall Street forecasts anticipate two more hikes by the September 25 meeting — totalling 150 plus 150 bases worth of increased lending costs with the potential for three 150 points tightening made earlier in 2022 tightening made earlier 150 points of tightening — taking total lending costs by 300 basis points!

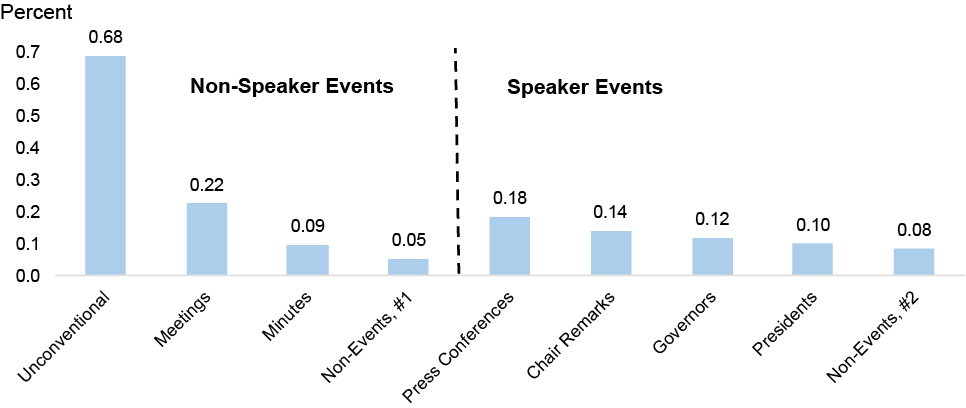

Wednesday’s move by the Federal Reserve to raise its overnight lending rate from 2.125%-2.5% was one of its most aggressive moves since using OFR as its primary monetary tool in the early 90s, taking rates back up where they peaked in 2019.

Real Estate Implications Amid Rising Interest Rates

Its Real estate has seen unprecedented activity over the past several years, driven by record-low mortgage rates fueling an explosion of homebuying activity and property values. Unfortunately, however, Federal Reserve rate hikes are starting to impact this dynamic housing market sector – mortgage rates have begun increasing gradually, making financing purchases slightly more costly for potential homebuyers.

Homebuyers who face rising mortgage rates may need to adjust their expectations and budgets accordingly. Finding the most competitive loan rates should become even more essential. At the same time, homeowners with adjustable-rate mortgages (ARMs) may wish to refinance into fixed-rate loans to prevent possible future rate hikes.

As interest rates increase, consumers may become more wary of their spending. Because higher interest rates can lead to increased monthly payments on credit cards and other forms of revolving debt, carrying balances may become costlier; as a result, individuals may choose to reduce discretionary spending to manage their debt load effectively.

Rising interest rates can immediately and dramatically impact investments and stock market volatility, especially those assets sensitive to changes in borrowing costs, such as bonds. Bond prices tend to decrease when interest rates increase as newer bonds with higher yields become more desirable than existing lower-yielding ones.

The Role of Inflation Expectations

The Federal Reserve’s interest rate hikes are partly a reaction to surging inflation. With their goal to stabilize prices, their actions can alter inflation expectations among businesses and consumers alike.

International Implications of Higher Interest Rates

The Federal Reserve’s monetary policy decisions have repercussions far beyond American borders. A series of rate hikes can cause the U.S. dollar to strengthen relative to other currencies, providing consumers with cheaper imported goods, but this can make U.S. exports more costly for international buyers, potentially impacting American exporters.

Rising interest rates can seriously impact retirement planning and fixed-income investments for retirees and those nearing retirement. Retirees rely heavily on fixed-income investments like bonds for steady income; as interest rates increase, their yields rise, making new bonds more appealing; however, existing ones with lower results could decrease significantly in value.

Communication by the Federal Reserve and Market Reaction

Communication between the Federal Reserve and its market can tremendously affect investor expectations and behaviour, especially those related to its future rate hike plans. Statements or press conferences this central bank gave could result in market movements or volatility, underscoring its importance.

Fiscal Policy as an Instrument to Control Inflation

While monetary policy, such as interest rates, plays a dominant role in managing inflation, fiscal policy plays a vital role too. Governments’ deliberations regarding taxes, spending decisions and other financial issues are part of fiscal policy implementation.

Higher interest rates can have severe ramifications for business investments and expansion decisions, including capital expenditure plans that delay or scale back specific projects, which affects job creation and economic development.

Balance Short-Term and Long-Term Goals

The Federal Reserve faces the formidable task of balancing short-term economic concerns, such as inflation management, and long-term goals, like sustainable growth and employment. Interest rate decisions have far-reaching repercussions in different parts of the economy, and the central bank must carefully weigh any tradeoffs or potential side effects before taking any actions.

Technology and Innovation in Economic Resilience

Technology plays an essential role in building economic resilience in an ever-evolving economic environment characterized by fluctuating interest rates. Technological advancements may lead to improved productivity, cost efficiencies, and new business opportunities allowing businesses to adapt quickly to shifting conditions.

Digital financial services offer consumers and businesses more flexible and accessible financial products to manage their finances more effectively in light of fluctuating interest rates.

As central banks respond to changes in the interest rate policy of the Federal Reserve, global economies may experience changes in capital flows, exchange rates, and trade dynamics. International cooperation among central banks becomes essential to effectively managing our complex global financial system.