Understanding USA Wire and Its Importance

USA Wire is a financial service that enables individuals and businesses to transfer funds electronically across domestic and international borders. It facilitates real-time, same-day, or next-day transfers, making it a preferred choice for urgent transactions. The significance of USA Wire lies in its ability to ensure swift, secure, and convenient money transfers, eliminating geographical barriers.

The History of USA Wire Services

The concept of wire transfers dates back to the late 19th century when telegraph companies offered money transfer services. Over the years, advancements in communication technologies have streamlined the process, leading to the birth of electronic funds transfer (EFT) systems like USA Wire. It has become an integral part of the modern banking and financial landscape.

How USA Wire Works: Sending and Receiving Funds

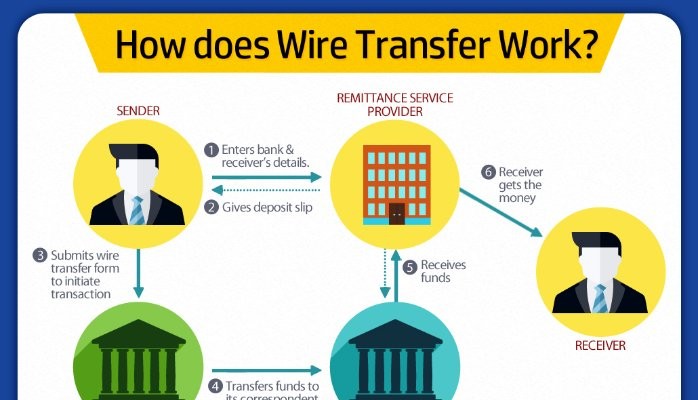

To initiate a USA Wire transfer, the sender’s bank gathers relevant information, including the recipient’s account details and the receiving bank’s routing number. This data is then securely transmitted through the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network or other payment gateways. The receiving bank processes the incoming transfer and credits the funds to the recipient’s account.

Advantages of Using USA Wire for Transactions

- Speed: USA Wire enables rapid fund transfers, reducing transaction times significantly compared to traditional methods.

- Security: The process involves robust security measures, minimizing the risk of fraud and unauthorized access.

- Global Reach: USA Wire supports cross-border transactions, making it ideal for international trade and remittances.

- Certainty: With same-day or next-day delivery, the sender and receiver have clarity on the transaction status.

Security Measures in USA Wire Transfers

USA Wire service providers implement several security protocols to protect users’ financial information. Multi-factor authentication, encryption, and secure communication channels are some standard practices. Regular audits and compliance with financial regulations ensure the safety of transactions.

Common Uses of USA Wire in Different Industries

Various industries leverage USA Wire services for diverse purposes. Businesses utilize it for supplier payments, payroll processing, and expedited transactions. E-commerce platforms often rely on USA Wire to facilitate quick and secure customer payments. Moreover, the real estate sector often uses wire transfers for property transactions.

Challenges and Risks of USA Wire Transfers

While USA Wire offers numerous advantages, it also presents challenges and risks. Delays in processing, especially during peak times, may occur. Additionally, fraudulent activities and cyberattacks pose security threats. Users must stay vigilant and adopt best practices to mitigate these risks.

Comparison with Other Payment Methods

It stands out for its speed and real-time processing capabilities when evaluating USA Wire against alternative payment methods like Automated Clearing Houses (ACH), credit cards, and cryptocurrencies. However, fees associated with wire transfers can be higher than other payment options, making cost-effectiveness an essential consideration.

Tips for Cost-Effective USA Wire Transfers

- Choose Appropriate Timing: Schedule wire transfers during non-peak hours to avoid extra charges.

- Negotiate Fees: Speak to your bank or wire service provider to explore fee waivers or discounts for frequent transactions.

- Consolidate Transfers: Consolidate multiple smaller transfers into a single, larger one to minimize fees.

Future of USA Wire Services

The future of USA Wire services looks promising as advancements in financial technology continue to enhance the overall transaction experience. Integrating blockchain and adopting faster payment systems are expected to further streamline wire transfers and reduce costs.

Conclusion

In conclusion, USA Wire services have revolutionized how funds are transferred domestically and internationally. Its speed, security, and global reach make it an attractive choice for businesses and individuals. However, users should know the challenges and risks of wire transfers and take necessary precautions. As technology evolves, we can expect USA Wire services to become even more efficient and cost-effective, shaping the future of global finance.

FAQs

- Q: Can I send USA Wire transfers from any bank?

A: Most banks offer USA Wire services, but it’s essential to verify with your specific bank about its availability. - Q: Are there any restrictions on the amount I can transfer via USA Wire?

A: While banks or wire service providers may set limits, USA Wire typically allows large transaction amounts. - Q: How long does a USA Wire transfer take to reach the recipient?

A: USA Wire transfers can be real-time, same-day, or next day, depending on the service provider and destination. - Q: Can I reverse a USA Wire transfer if I make a mistake?

A: USA Wire transfers are usually irrevocable, so it’s crucial to double-check the recipient’s details before initiating the transfer. - Q: Is USA Wire more secure than online payment systems?

A: USA Wire and online payment systems both employ security measures, but USA Wire’s direct bank-to-bank transfer adds an extra layer of security.