According to property-sharing websites, more over-50s have begun searching for house and flat shares due to rising housing costs.

Sharing is usually associated with younger people, but what’s like sharing when you are over 50?

Karen Miles, 66, moved into a 13-person house five years ago to save money and cut expenses.

She previously resided in a one-bedroom flat just outside Eastbourne but struggled to pay her monthly rent and bills, totalling approximately PS560.

Now she pays PS500 per month in rent for a room, without bills included, in a shared house in town.

Karen lives with housemates who range in age from early-20s to early-50s, who get along well enough but don’t socialise together often enough; Karen works part-time as a housekeeper and says sharing with younger people may present problems.

“Spending lockdown with my 88-year-old flatmate.”

Due to a shortage of homes for rent, bidding wars often ensue. She has previously experienced issues with some flatmates being noisy while sharing the kitchen and bathroom can quickly become unhygienic.

However, she noted the added advantage of having other people around.

“If I moved somewhere alone, I might feel quite lonely,” she added.

With prices increasing, Karen has searched for an affordable one-bedroom flat, yet she has found no suitable options.

She would prefer sharing with friends but noted that it could be challenging for older people to find someone of a similar age to rent with.

“My friends all have husbands and families, so that it can be tough,” she lamented.

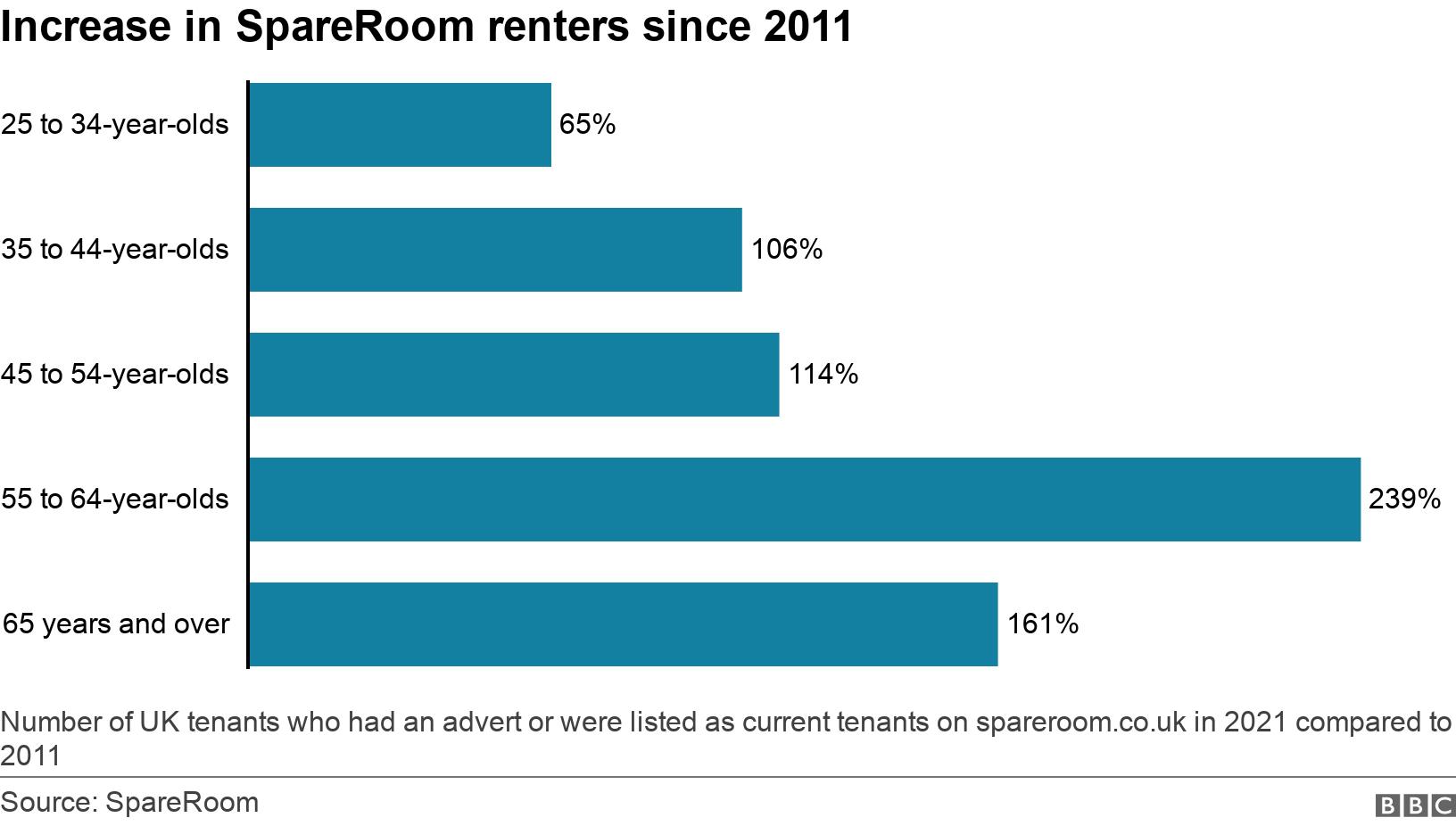

SpareRoom, one of the leading flat-sharing sites, reported an astounding 239% surge in 55 to 64-year-olds searching for house shares since 2011 and 114% for 45 to 54-year-olds looking for house shares.

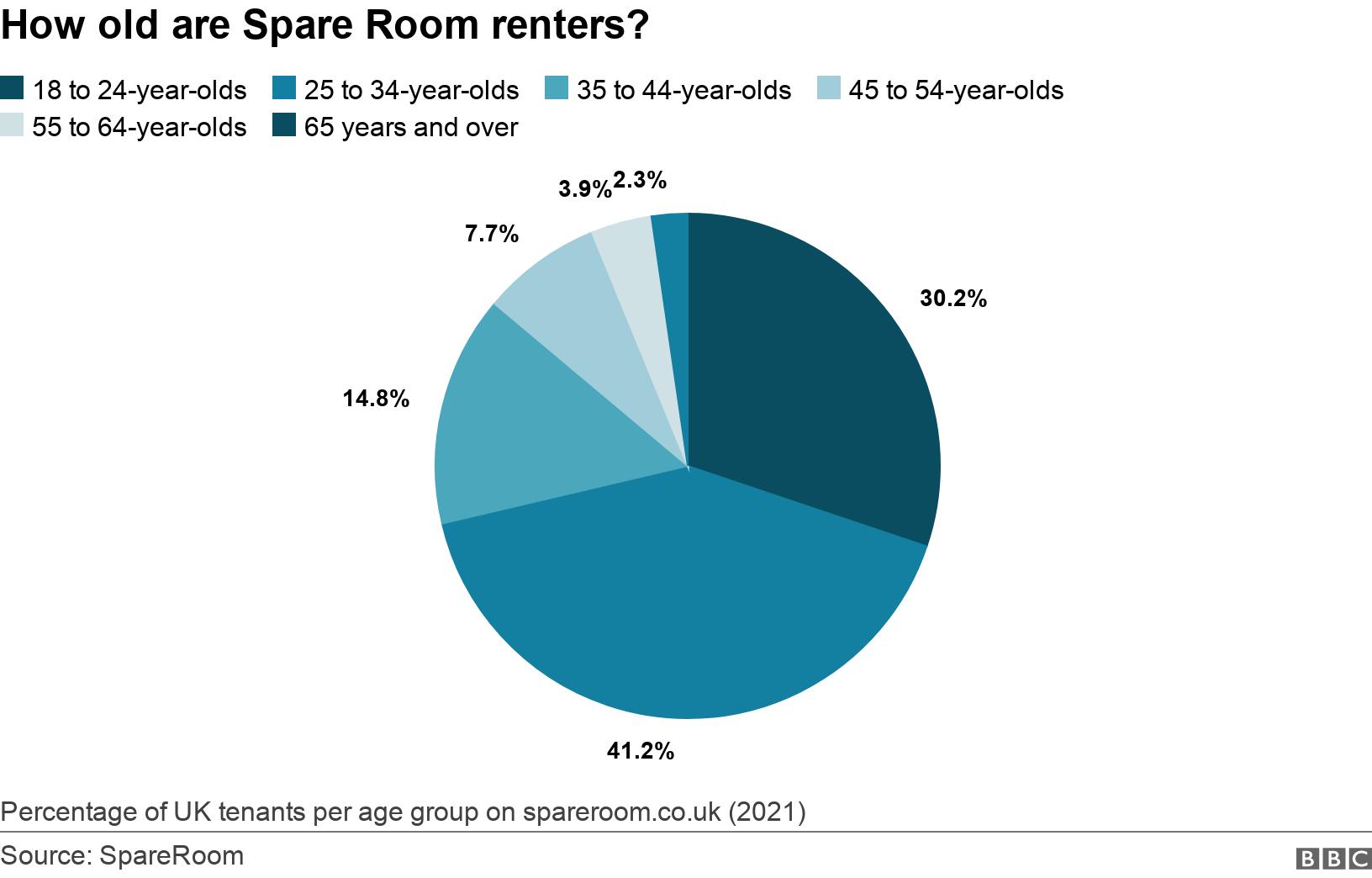

However, individuals between 25-34 make up the bulk of sharers.

SpareRoom Communications Director Matt Hutchinson highlighted affordability as one of the primary drivers behind an increase in older people’s house-sharing.

He told BBC News that rising costs associated with renting and buying homes have meant more people were sharing for longer, becoming lifelong renters, while people coming out of long-term relationships who might previously have considered purchasing or renting one-bedroom flats were now “priced out”.

Mr Hutchinson said he anticipated this trend would continue as housing and other expenses increased further.

Sarah Coles, a Senior Personal Finance Analyst from Hargreaves Lansdown, noted that official statistics support this notion of older renters.

She pointed out that figures from the Office for National Statistics (ONS) demonstrate how renters feel the effects of the cost-of-living crisis more acutely, as they spend a more significant proportion of their income on housing expenses than homeowners.

Mortgage holders tend to be vulnerable to rent increases since many have fixed-rate contracts.

According to ONS data, Rental prices have steadily increased in the UK since Covid restrictions were lifted.

Rents have seen the most significant annual price growth rate since January 2016 since high demand contributed to an increase of 3.2% year-on-year through July.

Rightmove recently reported average asking rents outside London had hit a record high – an 11.8% increase year-on-year.

Cohabitants, an online house-sharing service for those over 40, reported increased demand from older age groups since its founding in 2016.

Over the last six months, they reported a 44% surge in users compared to the previous year.

55 to 64-year-olds saw an increase of 51%, while 45 to 54-year-olds experienced 35%.

Eva Orasch, co-founder of ShareAge.org.uk, noted that two long-term trends contributing to an increase in sharing among older age groups were the UK’s ageing population and increasing housing costs.

Short-term, she highlighted how rising living costs and the pandemic were contributing factors, and some individuals no longer desired to live alone due to the lockdown.

A 2021 survey with more than 1,500 users showed that 45% had chosen to share solely financial considerations; 48% shared financially and socially.

Susan Laybourn, 58, began house-sharing to reduce expenses in March 2020.

Most recently, she has been sharing in Trefnant, north Wales, with an aged lady landlord and a man aged 25.

After finding work as a locum podiatrist for the NHS, Susan found it impossible to secure affordable accommodations independently.

Many houses in the area are let as holiday rentals, and Susan reported that demand had already outstripped supply for such properties.

At one point, she considered trying to find housing on her own; there were some available flats near Rhyl.

“But when I called to inquire about them, they told me ‘they are already gone.’

She further noted that not having a permanent job and often needing short-term rental contracts also counted against her when searching for somewhere suitable.

Youth living in tents due to house prices have become common.

Rental costs increase with workers returning to work, according to Susan. While she would prefer living alone or with one other similar-aged individual – and could afford such arrangements – sharing has proved much less costly; her current room costs only PS400 monthly, including utilities.

“If I could find somewhere here on my own, the rent alone would probably increase by at least PS200 more,” she stated. The additional bills could further add up quickly.

“And when it comes to energy bills skyrocketing and everything, I feel fortunate not to be privately renting by myself because otherwise, it would just be wasted money that could be put towards saving more.

She hopes to purchase her apartment in the future but believes that her age and lack of permanent employment preclude her from getting a mortgage loan.

Susan expressed that having company was essential when moving into a new area, and she gets along well with her live-in landlady.

However, she acknowledged it could be challenging to find someone her age to houseshare with because a stigma remains associated with older adults house-sharing.

She previously expressed shame for being unable to rent her place.

“I have come to terms with it and am now trying to see the positive aspects rather than dwelling on any negatives.

Examining the Current Landscape of UK Housing

Rising housing costs in the UK have created a problematic landscape for many over 50. Although house and flat sharing were once thought to be restricted to younger demographics, an increasing number of over-50s are turning to this option to manage mounting expenses. This trend represents a more significant societal shift, where homeownership becomes less accessible over time across age groups.

Karen’s Experience Navigating Shared Living Spaces

Karen Miles of Eastbourne sought a house share five years ago to relieve financial strains. While living with individuals from varying age groups was rewarding in terms of company, noise issues and cleanliness concerns presented challenges that required proper communication and understanding between all those sharing living spaces, regardless of age.

Affordability and Aging Population

House-sharing among older individuals has seen an exponential surge due to affordability. Rising rental and purchasing costs are pushing people into longer-term sharing arrangements that include renting rather than owning properties, leading to what some call the “lifetime renters” phenomenon. This trend is particularly evident for those who are suddenly single after long-term relationships end, who can no longer afford to live alone.

Finding Age-Appropriate Housemates

One of the most significant obstacles faced by older individuals seeking houseshares is finding individuals of similar ages. Unfortunately, most houseshares remain between 25 to 34 years old, making it more difficult for those over 35 to connect with suitable housemates. Although websites targeting more senior age groups have seen increased demand, finding compatible living arrangements remains a delicate balancing act.

Housing Crisis and Cost of Living

The UK housing crisis has far-reaching repercussions, with renters feeling its acute impact. Rising housing costs especially hard hit renters on fixed incomes as they dedicate a more significant proportion of their income toward rent than homeowners do. Furthermore, energy bills and other essential expenses continue to escalate exponentially, making shared living arrangements an attractive solution.