Millions of residents across the United Kingdom are bracing themselves for huge increases to their energy bills over the coming months, marking yet another record-setting price hike year.

The crisis has gripped Europe since last fall. Prices have skyrocketed across Europe due to increased demand as countries lift pandemic lockdowns. At the same time, Russia’s invasion of Ukraine in late February, and consequent decreases in its oil and natural gas exports to Europe, have only compounded their increases further.

Analysts told CNN Business that UK energy prices have recently become higher than similar economies like France and Italy, according to their estimates. Brits have experienced much more significant price increases than many European nations – including Germany, where decades-long policies regarding energy have been altered due to the Ukraine conflict.

This week, the Office for National Statistics reported that UK natural gas prices have risen nearly 96% since July 2015, while electricity costs have increased by 54%.

Deutsche Bank estimates that annual consumer price inflation for gas and electricity in the United Kingdom could hit an average of about 80% this year compared to an estimated average of 40% across 19 eurozone nations, as per their analysis.

Average annual energy bills could soar past PS4,000 ($4,820) as early as January and even hit PS5,000 ($6,000) later in spring, rising from about PS2,400. Millions could be forced into poverty as a result of increasing bills; leaders of the UK National Health Service warned Friday of an impending “humanitarian crisis,” saying many people could become sick this winter as they must decide between skipping meals to heat their homes or living in cold, damp and generally unpleasant conditions, they stated.

Overall, UK inflation exceeded 10% in July compared with 8.9% across much of Europe; Brexit does not appear to be the primary culprit here, so why are British energy bills increasing more quickly than elsewhere in Europe?

A broken market

As wholesale costs skyrocketed last year, 31 smaller UK energy suppliers who previously offered competitive pricing went bankrupt, forcing millions of their customers onto larger energy providers and paying higher bills.

Henning Gloystein, director of energy, climate, and resources at Eurasia Group, told CNN Business that the British government’s energy market design created more opportunities for small companies to act like brokers rather than essential providers of essential utilities.

“Many UK retail energy providers were not energy producers; rather, they purchased electricity and gas at wholesale markets before selling it directly to end-customers such as households,” Gloystein noted.

As soon as wholesale costs surpassed suppliers’ legal charges, they went bankrupt.

Europe operates differently, according to Gloystein. Many European nations impose tighter regulations on suppliers to protect consumers from sudden price spikes and sudden cost increases.

Household prices in the UK are subject to a cap, which is adjusted every six months – although that period could soon be cut down to three – meaning bills rise more rapidly as wholesale costs increase.

Sanjay Raja, Deutsche Bank’s Chief UK Economist, told CNN Business there is an arrangement pushing up prices slightly as we transition towards quarterly gas pricing models. Suppliers are passing on increases more quickly to consumers.

Raja states that Britain is facing an “economic perfect storm”, leading to higher energy bills and forcing it into debt.

Lack of storage

He noted that most homes are typically supplied with natural gas while electricity, nuclear energy and renewable sources account for the vast majority of European Union energy consumption.

Deutsche Bank reports that Turkey relies on natural gas to generate 40% of its electricity production, compared to less than one-fifth for Europe.

“This double whammy effect and Britain’s overreliance on gas are two main contributors to why gas prices seem more elevated here,” one commentator said.

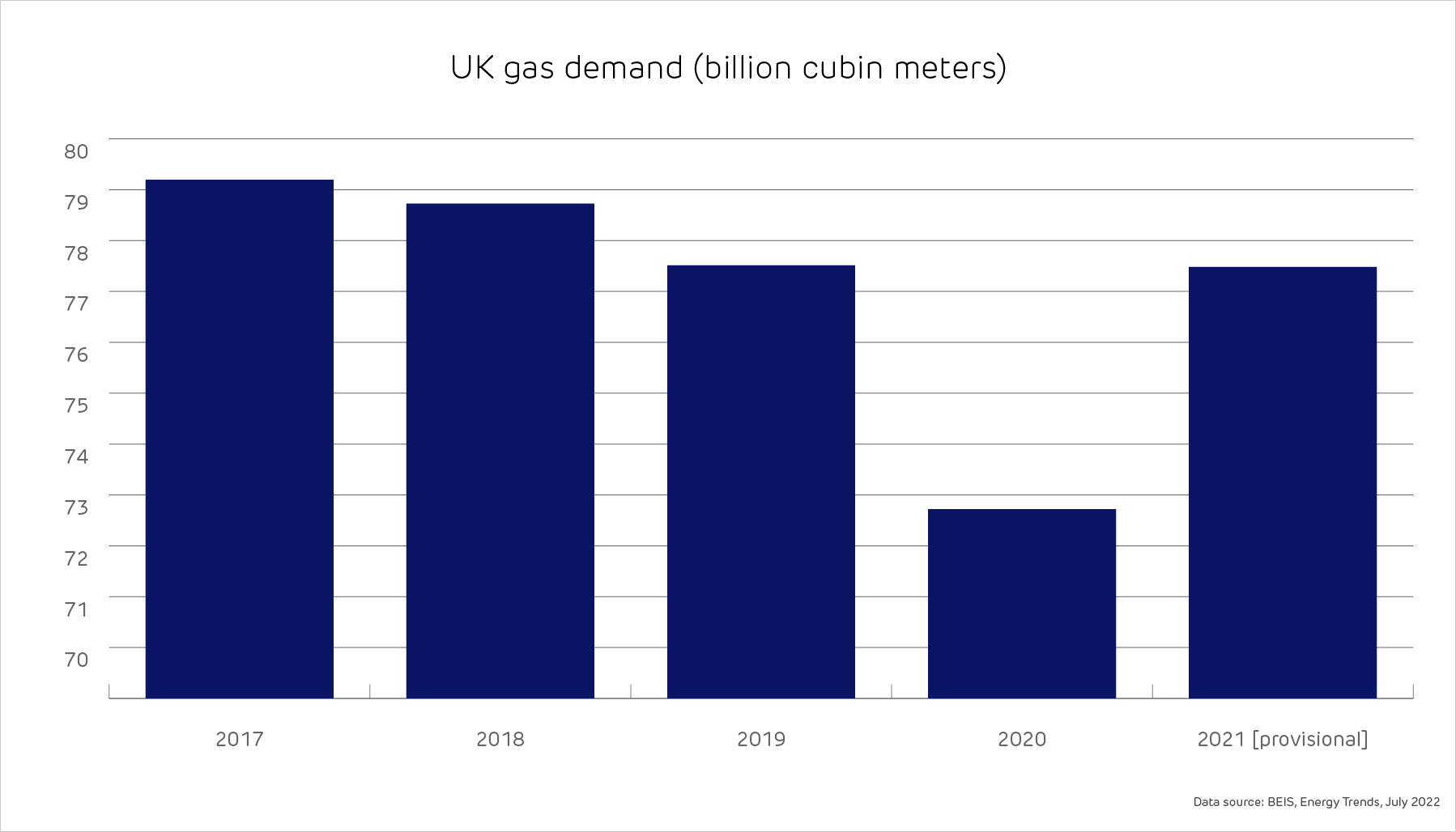

According to government business department records, United Kingdom producers account for roughly half of worldwide gas production; however, North Sea output reached its lowest-ever level due to maintenance work in 2018.

Storage issues have only compounded the situation. Centrica (CPYYF), a UK energy company, recently closed its largest gas storage facility; discussions are underway with the government to reopen it this winter. Europe boasts far greater storage capacities and has rapidly filled them in anticipation of winter and any potential Russian gas stop-off.

According to an analysis by Auxilione, UK natural gas contracts for next year’s first quarter are nearly 7% more expensive than European benchmark contract prices due to Europe having created a cushion against winter-season costs.

Lacking storage facilities, the United Kingdom must rely on “real-time flows” of natural gas from North Sea fields, Norway and Belgium – as well as Liquefied Natural Gas imports – according to Tony Jordan of Auxilione.

“Winter forces us to live more in the present,” he explained.

Europe’s gas remains costly. According to Auxilione, spot prices reached an all-time high on Friday of EUR242 ($244) per megawatt hour on average, much higher than UK prices which trade at approximately the equivalent of EUR160 per megawatt hour. However, higher European demand as winter sets in can explain much of this difference.

Germany declared a gas crisis in June when Russia reduced flows through its critical Nord Stream 1 pipeline by two-thirds, pushing Germany closer towards rationing industrial usage of natural gas.

Minimal government support

With rising bills, governments across Europe have responded by providing minimal government assistance to ease household financial strain.

Raja pointed out that no support offered by the UK government so far had directly subsided consumer energy prices. To ease their pain, they issued millions of households a PS150 rebate on local taxes to help ease pressures.

Anti-poverty campaigners predict more assistance is coming soon, yet it won’t go nearly far enough.

In May, the government unveiled a PS15 billion ($18 billion) support package and issued 29 million households a PS400 ($482) credit from October, which will be distributed over six months.

On the other hand, France has limited its electricity price increases to no more than four per cent before the year’s end.

Raja noted that other countries “have had more direct intervention regarding energy prices, leading to UK gas and electricity rates being slightly higher.”

Germany announced on Thursday its plans to decrease sales tax on gas from 19% to 7% until March 2024 to more than offset new levies introduced to cover gas storage costs. According to German broadcaster ZDF, companies were instructed by their governments to pass this reduction on to customers as part of an order placed with German broadcaster ZDF.

Liz Truss is currently considered a frontrunner to become the next Prime Minister of the UK next month; however, she has not commented on how she plans to provide further help for households beyond lowering taxes.

Labour is calling on oil and gas companies to extend a windfall tax on profits to help fund an energy bill freeze this winter. “The Global Energy Crisis and its Effect on the UK: An Unprecedented Challenge”.

Europe’s Current Energy Crisis

Since last fall, Europe has been gripped by an energy crisis that continues to weaken economies and households. The United Kingdom, in particular, is bearing the brunt of it, with record price increases impacting millions. Pandemic lockdowns were one contributing factor; Russia’s invasion of Ukraine further complicated matters by restricting oil and gas exports – both major contributing factors.

Exploring the Unique Aspects of UK Energy Price Surge

Although the energy crisis impacts many European nations, Britain has been a brutal hit. Analysts indicate that its spike in energy prices has outshone those seen elsewhere, particularly in France and Italy, where prices have also seen sharp increases due to geopolitical events affecting their energy policies.

Increased Natural Gas and Electricity Prices

The Office for National Statistics announced that UK natural gas prices had increased nearly 96% year-on-year before July, while electricity costs surged 54%. Deutsche Bank analysis predicts annual consumer price inflation for gas and electricity could hit up to 80% – twice that seen across eurozone averages of 40% inflation.

Soaring Energy Bills

As energy bills in the UK reach PS4,000 by January and get PS5,000 later in spring compared to their current average of PS2,000, their costs threaten to push millions further into poverty. UK National Health Service leaders have warned of an impending humanitarian crisis.

Brexit and Energy Bills

Surprisingly, Brexit is not a significant contributor to Britain’s energy bill increases; instead, the energy market design makes smaller energy companies more vulnerable to bankruptcy as wholesale costs spike upward.

Damaged Market Structure

Last year, as wholesale costs skyrocketed rapidly, 31 smaller UK energy providers that traditionally offered competitive prices went bankrupt, forcing millions of customers to switch suppliers with higher bills – the design of the UK energy market where smaller providers functioned more like brokers than actual energy suppliers only compounded the problem further.

Tighter Regulations in Europe

Many European countries employ stricter regulations on energy suppliers that safeguard them against sudden price spikes. The UK’s energy price cap, adjusted every six months and soon quarterly, allows suppliers to pass along wholesale gas price increases more rapidly – contributing further to an upward spiral in energy bills.

Overdependence on Natural Gas

The UK’s overreliance on natural gas for heating and electricity generation contributes to rising energy prices, unlike many European nations that rely more heavily on renewables, nuclear power, or hydro energy generation sources—furthermore, our 40% gas dependency for electricity generation compounds this issue.

Lack of Storage Space

The UK’s lack of sufficient natural gas storage capacity has only compounded this problem. Due to limited options for gas storage, real-time flows from North Sea, Norway, Belgium and LNG imports become more reliant. European nations, by comparison, have constructed buffer storage ahead of the winter season to manage price fluctuations more easily.

UK Gas Price Trends and Scenarios

UK natural gas contracts for the first quarter of 2016 are approximately 7% more expensive than European benchmark contract prices. This may be attributable to Europe’s larger gas storage capacity, enabling it to manage winter months and expenses more effectively than its UK counterpart.